Where should your home be priced?

There are three main pricing strategies - pricing your home: above, at, or below its market value.

There are three main pricing strategies - pricing your home: above, at, or below its market value.

When real estate prices are declining, and the market is inundated with all sorts of distressed homes, setting a new listing price can be unnerving. Should you set the listing price at the target amount from the market analysis showing what buyers should be willing to pay for your home compared to the recent sold comps? But then, will you find that the market has dropped another 5% and you are now priced too high? Or do you roll the dice and price below nearby listings to attract buyers, hoping that enough of them place offers to get some competition going? Or try to price it high to leave room to negotiate?

Again, I'll cut to the chase: Priced at market value, Always a good strategy - that's what your home is worth!

Pricing Strategies

BONUS TRUTH - The "High Price Tactic"

This is another truth regarding Real Estate that I am sharing with you. Beware of the high price tactic. It has been used for years and continues to hurt uninformed sellers. Once you read this page you will not only be able to see when and why this strategy is being used on you but now you will be able to profit by avoiding it! This tactic is also called "Buying Your Listing".

Priced above market value Sellers like to price their home high, thinking that someone just might pay it. That's unlikely - buyers shopping for a home know exactly what the market is like, and won't be fooled into paying more than it's worth.

HOW YOUR ASKING PRICE AFFECTS YOUR SELLING PRICE

There are 4 common strategies that most sellers use to price their homes. It is unwise to assume that a higher asking price will net you a higher selling price. In fact, often this equation works in reverse, especially if you're not paying attention to what the market is telling you. Remember, you cannot "fool the market" with a high price. Please consider these facts when you set your asking price.

Clearly Overpriced - Every seller like you wants to realize the most amount of money they can for their home, and every real estate agent knows this. If more than one agent is competing for your listing, an easy way for the agent to win you over is to over-inflate the value of your home. Often we will see new listings that are priced at 10 - 20% over their true market value. This is very unfair to you - and once you are listed with the agent who convinced you to go with the high price, that agent will persistently ask and pressure you for price reductions in order to sell... ouch!

This is called the "High Price Tactic" and is clearly not in your best interest. In most cases the market won't and can't be fooled. As a result, your home could languish on the market for months, leaving you with a couple of important drawbacks:

• your home is likely to be labeled as a "troubled" house by other agents, leading to a lower than fair market price when an offer is finally made

• you have been greatly inconvenienced with having to constantly have your home in "perfect showing" condition for months ... for nothing.

• homes that are clearly overpriced often expire unsold, forcing you to go through the whole listing process all over again, often with poorer results than had you listed at the right price in the beginning.

Somewhat Overpriced - Often about 3/4 of the homes on the market are 5-10% overpriced. These homes will also sit on the market longer than anyone would want. There is usually one of two factors at play here: either you believe in your heart that your home is really worth this much despite what the market has logically indicated (after all, there's a lot of emotion caught up in this issue), OR you've left a little too much room for negotiating. Either way, this strategy will cost you both in terms of time on the market and ultimatey the price you will receive.

Priced Correctly at Market Value- Smart sellers understand that real estate is part of the capitalistic system of supply and demand. They will carefully and realistically price their homes based on a thorough and complete analysis of other sales and the "competing" homes on the market. These competitively priced homes usually sell within a reasonable time-frame and sell for the best price possible. When your home is priced correctly it should sell in any market!

Priced Below Market Value - Some sellers are highly motivated and require a quick sale. The theory is to price the home to attract multiple offers and sell fast - hopefully in a few days - at, or above, the lower asking price. Be cautious that the agent suggesting this method is making this recommendation with your best interest in mind. A popular recommendation is to list your home 10% below comparable properties in your neighborhood, and wait for the bidding war to start! The argument is that by doing this you will strike a deal within days instead of months, saving thousands of dollars in carrying costs. In the current market the risks are that: (1) you may not get multiple offers and a bidding war, and (2) you’ll get offers well below what you’re really willing to accept.

Clearly Overpriced - Every seller like you wants to realize the most amount of money they can for their home, and every real estate agent knows this. If more than one agent is competing for your listing, an easy way for the agent to win you over is to over-inflate the value of your home. Often we will see new listings that are priced at 10 - 20% over their true market value. This is very unfair to you - and once you are listed with the agent who convinced you to go with the high price, that agent will persistently ask and pressure you for price reductions in order to sell... ouch!

This is called the "High Price Tactic" and is clearly not in your best interest. In most cases the market won't and can't be fooled. As a result, your home could languish on the market for months, leaving you with a couple of important drawbacks:

• your home is likely to be labeled as a "troubled" house by other agents, leading to a lower than fair market price when an offer is finally made

• you have been greatly inconvenienced with having to constantly have your home in "perfect showing" condition for months ... for nothing.

• homes that are clearly overpriced often expire unsold, forcing you to go through the whole listing process all over again, often with poorer results than had you listed at the right price in the beginning.

Somewhat Overpriced - Often about 3/4 of the homes on the market are 5-10% overpriced. These homes will also sit on the market longer than anyone would want. There is usually one of two factors at play here: either you believe in your heart that your home is really worth this much despite what the market has logically indicated (after all, there's a lot of emotion caught up in this issue), OR you've left a little too much room for negotiating. Either way, this strategy will cost you both in terms of time on the market and ultimatey the price you will receive.

Priced Correctly at Market Value- Smart sellers understand that real estate is part of the capitalistic system of supply and demand. They will carefully and realistically price their homes based on a thorough and complete analysis of other sales and the "competing" homes on the market. These competitively priced homes usually sell within a reasonable time-frame and sell for the best price possible. When your home is priced correctly it should sell in any market!

Priced Below Market Value - Some sellers are highly motivated and require a quick sale. The theory is to price the home to attract multiple offers and sell fast - hopefully in a few days - at, or above, the lower asking price. Be cautious that the agent suggesting this method is making this recommendation with your best interest in mind. A popular recommendation is to list your home 10% below comparable properties in your neighborhood, and wait for the bidding war to start! The argument is that by doing this you will strike a deal within days instead of months, saving thousands of dollars in carrying costs. In the current market the risks are that: (1) you may not get multiple offers and a bidding war, and (2) you’ll get offers well below what you’re really willing to accept.

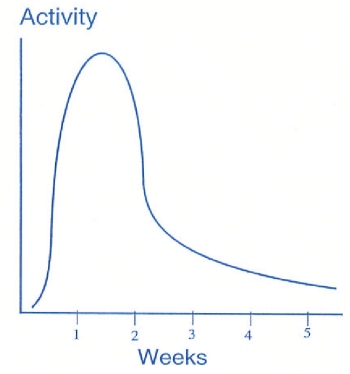

- The Majority of prospect activity on a new listing occurs in the early period of marketing. This happens because real estate agents maintain an inventory of active prospects that have been cultivated over time.When a home is newly listed, real estate agents will arrange for the buyers to see it. Once this "actively looking" group has seen the property, showing activity decreases to only those buyers that are new to the market.For this reason it is important that sellers have their home in the best condition and at the best price at first exposure to the market.

How to get the best price for your home.

- When you decide to sell your home, determining your asking price is one of the most important decisions you will ever make. Depending on how a buyer finds your home, price is often the first thing he or she sees. Many homes are discarded by prospective buyers as not being in the appropriate price range before these homes are given a chance to be shown.

- Your asking price is often your home's "first impression", and if you want to realize the most money you can from your home's sale, it is imperative that you make a good first impression.

- Because this is not as easy as it sounds, your pricing strategy should not be taken lightly. Pricing too high can be very costly to you. Taking a look at what homes in your neighbourhood have sold for is only a small part of the process, and this on it's own is not nearly enough to help you make the best decision for yourself and your family. I will guide you through the process along with educating you about the other items to consider.

- The information I give you here will help you understand some important factors about pricing strategy to help you not only sell your home, but sell it for the price you want.

PRICING STRATEGY STARTS WITH GOOD INFORMATION

Before you can begin to know what your home is worth, you should do some research, bearing in mind the following:

- An analysis of what homes have recently sold for in your neighbourhood is NOT enough to help you properly price your home. A quick scan up and down the street at the prices of homes that have recently sold will give you a starting point. However, this is not nearly enough for you to base your entire pricing strategy on. It is most important for you to understand how buyers look for a home.

- Go back in your memory and think about how you conducted your house hunting search to find the home you are now thinking of selling. You most likely did not confine your search to a single neighbourhood, but perhaps you looked in different neighbourhoods or areas in order to find the home that best matched your needs and desires.

- The prospective buyers who will be viewing your home, will conduct their searches in a similar manner. That means they will be comparing your home to, for example; brand new builder homes, century homes, 10-20 year old homes, etc. They will also consider different suburbs or possibly even country properties. Each home will have a different look and feel and it's quite possible that a prospective buyer might consider all of these variables in the search for their home.

- You can see when you're selling your home, you're not just competing with the home around the corner, but also with all homes in other areas which have the same basic characteristics: i.e. number of rooms, overall living space, features and extras, etc.

So, Remember...

- Understanding buyer behavior when pricing your home is very important.

- Your asking price should be competitive with EVERY type of home that shares the same basic characteristics as yours.

- To come up with a the best price, a competitive price takes research on my part and yours. Call, email or text me anytime to get started.

Amy Bumpus

Coldwell Banker King Thompson—The Benadum Team

614-657-2005

abumpus@insight.rr.com